Fidelity Contributions: A Comprehensive Guide To Building Wealth Securely

Hey there, money-savvy friend! If you're reading this, chances are you're diving deep into the world of retirement planning and financial security. Fidelity contributions are one of those golden tickets to a stress-free future, and today, we’re breaking it all down for you. Whether you're just starting out or looking to refine your strategy, understanding how Fidelity contributions work can make all the difference in securing your financial future. So, buckle up, because we're about to deep-dive into the nitty-gritty of making your money work smarter, not harder.

Now, before we get into the juicy details, let's address the elephant in the room: Why should you care about Fidelity contributions? Simply put, they’re more than just a retirement savings tool. These contributions are part of a broader strategy that helps you grow your wealth over time while minimizing tax burdens. Who doesn’t want to keep more of their hard-earned cash, right? Let’s explore how Fidelity contributions can be your secret weapon in achieving financial independence.

One thing to keep in mind is that Fidelity contributions aren’t a one-size-fits-all solution. Depending on your income, age, and financial goals, there are different ways to maximize their benefits. From contribution limits to investment options, we’ll cover everything you need to know to make informed decisions. So, whether you're a rookie or a seasoned investor, this guide has got you covered. Let's get started!

- Income Limits For Food Stamps In Arkansas A Comprehensive Guide

- How Old Is Vince Mcmahon The Ultimate Guide To The Wwe Titans Age And Legacy

What Are Fidelity Contributions?

Fidelity contributions refer to the money you set aside into a Fidelity-managed retirement account, such as a 401(k), IRA, or Roth IRA. These accounts are designed to help you save for the long term while offering tax advantages that make them an attractive option for building wealth. Think of Fidelity contributions as planting seeds today that will grow into a lush forest by the time you retire.

Here’s the deal: Fidelity Investments is one of the largest financial services companies out there, and they offer a wide range of investment products tailored to different needs. When you contribute to a Fidelity account, your money is invested in a mix of stocks, bonds, and other assets based on your risk tolerance and financial goals. The key is consistency—regular contributions can compound over time, turning small amounts into significant savings.

Why Choose Fidelity Contributions?

Choosing Fidelity contributions isn’t just about picking a random investment platform. Fidelity stands out for several reasons:

- Who Is The Most Hated Person A Deep Dive Into Fame Hate And Human Psychology

- How Does A Netspend Card Work The Ultimate Guide For Your Financial Freedom

- Low Fees: Fidelity is known for offering some of the lowest fees in the industry, which means more of your money stays in your pocket.

- Wide Range of Investment Options: From index funds to ETFs, Fidelity offers a diverse portfolio that caters to various investment strategies.

- Customer Support: Need help? Fidelity has a robust customer support system to guide you through the process.

- Education Resources: They provide tons of free resources to help you become a smarter investor.

So, if you’re looking for a reliable partner in your financial journey, Fidelity contributions could be the right move for you. But remember, it’s not just about choosing Fidelity—it’s about understanding how to use their tools effectively.

Understanding Contribution Limits for Fidelity Accounts

One of the first things you need to know about Fidelity contributions is the contribution limits. These limits are set by the IRS to ensure fairness across the board. As of 2023, here’s what you need to know:

- 401(k) Contribution Limits: You can contribute up to $22,500 annually. If you’re 50 or older, you can make an additional $7,500 catch-up contribution.

- Traditional IRA Contribution Limits: The max is $6,500 per year, with a $1,000 catch-up contribution for those 50 and above.

- Roth IRA Contribution Limits: Similar to Traditional IRAs, the limit is $6,500, plus a $1,000 catch-up contribution for older investors.

These limits might seem like a bummer, but they’re actually designed to encourage consistent saving. Plus, there are ways to maximize your contributions, which we’ll talk about later. Just remember, the earlier you start, the more time your money has to grow.

How to Maximize Your Fidelity Contributions

Maximizing your Fidelity contributions isn’t just about hitting the contribution limits—it’s about optimizing your strategy. Here are a few tips:

- Start Early: Time is your best friend when it comes to investing. The earlier you start, the more your money can grow through compounding.

- Take Advantage of Employer Matches: If your employer offers a 401(k) match, contribute enough to get the full match. It’s basically free money!

- Automate Your Contributions: Set up automatic transfers to ensure you’re consistently adding to your account.

- Rebalance Regularly: Keep an eye on your portfolio and rebalance as needed to align with your risk tolerance.

By following these tips, you can make the most out of your Fidelity contributions and set yourself up for long-term success.

The Tax Advantages of Fidelity Contributions

Let’s talk about everyone’s favorite topic: taxes. One of the biggest perks of Fidelity contributions is the tax benefits they offer. Depending on the type of account you choose, you can either deduct contributions from your taxable income or enjoy tax-free withdrawals in retirement. Here’s how it breaks down:

Traditional IRAs and 401(k)s: Contributions are tax-deductible, which means you lower your taxable income for the year. However, withdrawals in retirement are taxed as ordinary income.

Roth IRAs and Roth 401(k)s: Contributions are made with after-tax dollars, so there’s no upfront tax deduction. But here’s the kicker: qualified withdrawals in retirement are completely tax-free. Talk about a win-win!

Understanding these tax implications is crucial for choosing the right account type based on your current and future tax brackets. And hey, who doesn’t love keeping more of their money?

Fidelity Contributions vs. Other Investment Platforms

With so many investment platforms out there, you might be wondering why Fidelity contributions are worth considering. Here’s a quick comparison:

- Vanguard: Known for its low-cost index funds, Vanguard is a strong competitor. However, Fidelity often edges out with better customer service and a wider range of investment options.

- Charles Schwab: Schwab offers similar services but tends to have slightly higher fees. Fidelity’s educational resources give it the upper hand for beginner investors.

- Robinhood: While Robinhood is great for trading, it doesn’t offer the same level of retirement planning tools as Fidelity.

Ultimately, the choice comes down to your personal preferences and investment goals. But for a comprehensive retirement planning solution, Fidelity contributions are hard to beat.

Investment Options Within Fidelity Contributions

One of the coolest things about Fidelity contributions is the variety of investment options available. Whether you’re a conservative investor or a risk-taker, there’s something for everyone:

- Index Funds: Low-cost and diversified, index funds are a great choice for hands-off investors.

- ETFs (Exchange-Traded Funds): Similar to index funds but more flexible, ETFs allow you to trade throughout the day like stocks.

- Individual Stocks: For those who want more control, Fidelity offers access to thousands of individual stocks.

- Bonds: If you’re looking for stability, bonds are a solid option to balance out your portfolio.

Choosing the right mix of investments is key to achieving your financial goals. Fidelity’s platform makes it easy to explore and adjust your portfolio as needed.

Common Mistakes to Avoid with Fidelity Contributions

Even the best-laid plans can go awry if you’re not careful. Here are some common mistakes to avoid:

- Not Starting Early Enough: Delaying contributions can cost you thousands in missed compounding opportunities.

- Ignoring Fees: High fees can eat into your returns, so always check the expense ratios of your investments.

- Withdrawing Too Soon: Early withdrawals come with penalties, so it’s best to leave your money alone until retirement.

- Overtrading: Constantly buying and selling can lead to unnecessary taxes and fees.

By steering clear of these pitfalls, you can stay on track to achieving your financial goals.

Building a Retirement Plan with Fidelity Contributions

Fidelity contributions are just one piece of the retirement planning puzzle. To build a comprehensive plan, consider the following steps:

- Set Clear Goals: Determine how much you’ll need in retirement and create a timeline for reaching that number.

- Assess Your Risk Tolerance: Understand your comfort level with market fluctuations and adjust your portfolio accordingly.

- Monitor Your Progress: Regularly review your accounts to ensure you’re on track to meet your goals.

- Seek Professional Advice: If you’re unsure where to start, consider consulting a financial advisor.

Remember, retirement planning isn’t a one-time event—it’s an ongoing process. Fidelity contributions can be a powerful tool in your arsenal, but they work best when integrated into a well-thought-out plan.

Real-Life Success Stories with Fidelity Contributions

Nothing motivates like real-life success stories. Here are a couple of examples of people who’ve achieved financial freedom through Fidelity contributions:

- Sarah: A teacher who started contributing to her 401(k) at age 25. By consistently maxing out her contributions and taking advantage of employer matches, Sarah now has over $1 million in her account at age 50.

- Mark: A small business owner who used Fidelity’s Roth IRA to save for retirement. Despite starting later in life, Mark’s disciplined approach allowed him to retire comfortably at age 62.

These stories prove that with the right strategy and perseverance, anyone can achieve financial independence through Fidelity contributions.

Conclusion: Take Control of Your Financial Future

And there you have it, folks! Fidelity contributions are a powerful tool for building wealth and securing your financial future. By understanding contribution limits, maximizing your strategy, and leveraging tax advantages, you can set yourself up for success in retirement. Remember, consistency is key—small contributions over time can add up to big results.

So, what’s next? Take action! Start by evaluating your current financial situation and setting clear goals. Then, explore the various investment options available through Fidelity and create a plan that works for you. And don’t forget to monitor your progress and adjust as needed.

Before you go, we’d love to hear from you. Have you started contributing to a Fidelity account? What’s been your experience so far? Drop a comment below or share this article with a friend who could benefit from the knowledge. Together, let’s build a brighter financial future!

Table of Contents

- Fidelity Contributions: A Comprehensive Guide to Building Wealth Securely

- What Are Fidelity Contributions?

- Why Choose Fidelity Contributions?

- Understanding Contribution Limits for Fidelity Accounts

- How to Maximize Your Fidelity Contributions

- The Tax Advantages of Fidelity Contributions

- Fidelity Contributions vs. Other Investment Platforms

- Investment Options Within Fidelity Contributions

- Common Mistakes to Avoid with Fidelity Contributions

- Building a Retirement Plan with Fidelity Contributions

- Real-Life Success Stories with Fidelity Contributions

- Conclusion: Take Control of Your Financial Future

- Diana Barrymore The Rising Star Whorsquos Taking Hollywood By Storm

- Mexican Food Waco Tx A Flavorful Journey Through The Heart Of Texas

Donating Privately Held SCorp Stock to Charity Fidelity Charitable

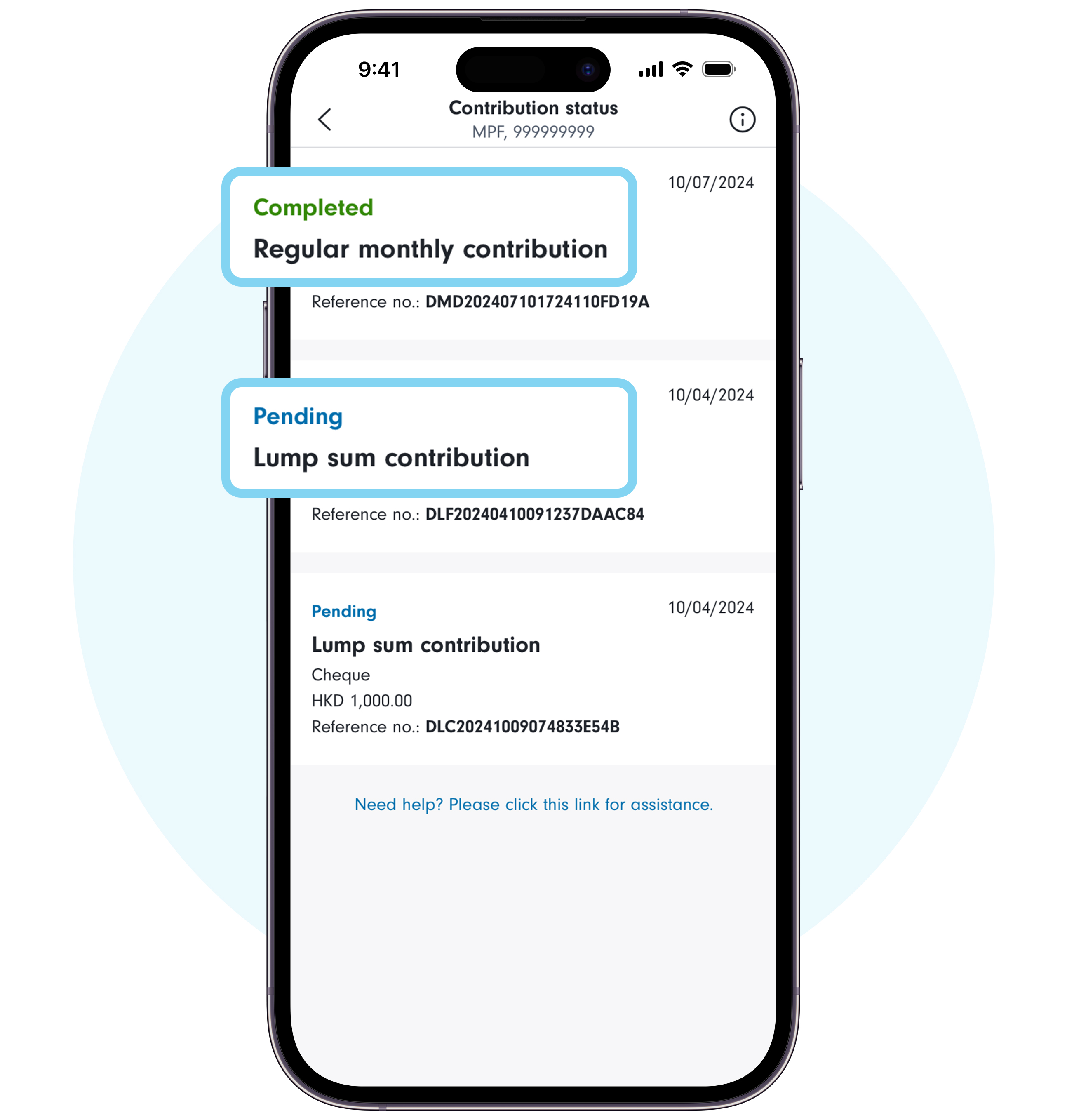

Fidelity MPF Tax Deductible Voluntary Contributions (TVC)

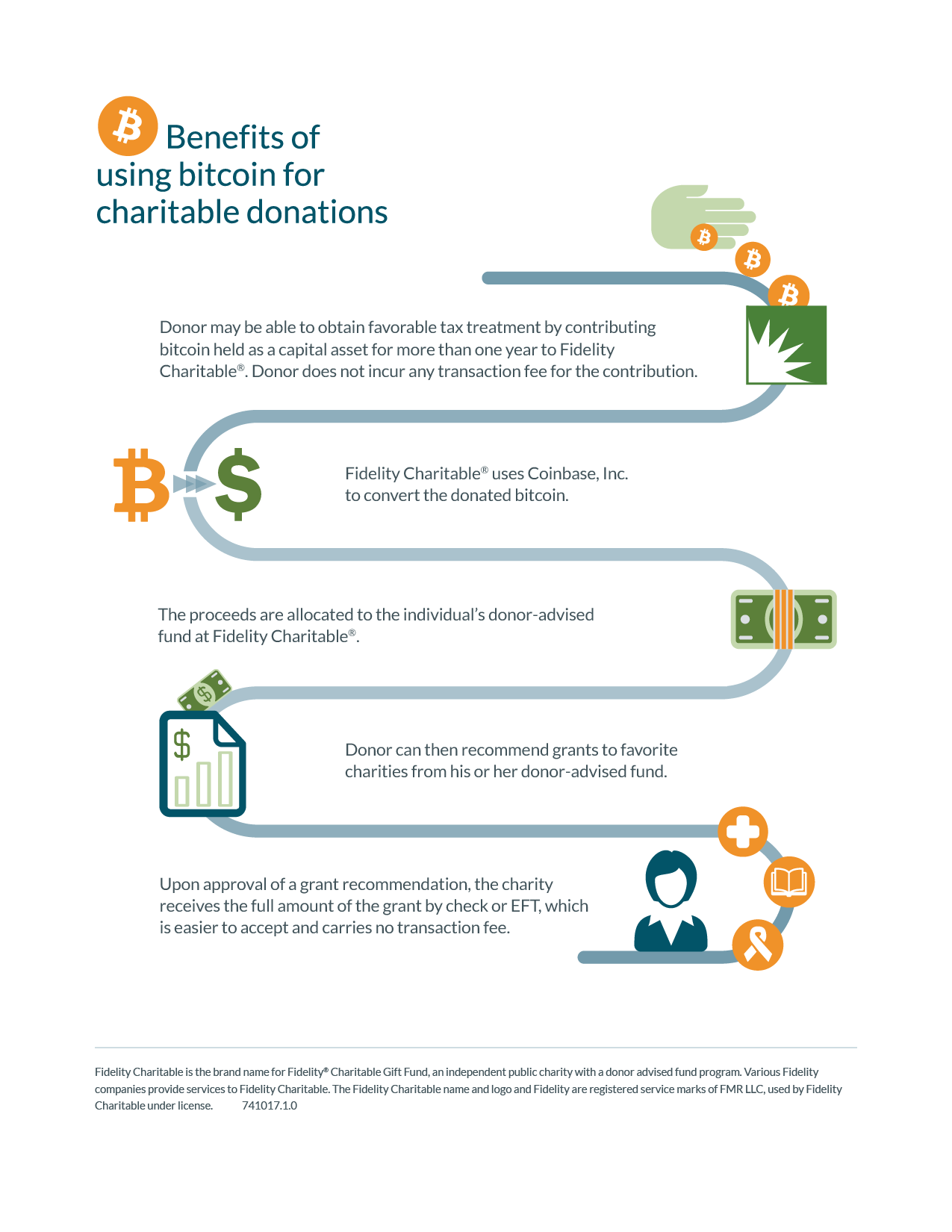

Donors Can Now Contribute Bitcoin to Fidelity Charitable to Fund