TJ Maxx Store Credit Card: Your Ultimate Guide To Shopping Smarter

Are you tired of paying full price for trendy clothes and home goods? Well, let me tell ya, TJ Maxx has got your back, and their store credit card is like the secret weapon you didn’t know you needed. Whether you’re a fashionista, a home decor enthusiast, or just someone who loves a good bargain, the TJ Maxx credit card might be the key to unlocking some serious savings. So, buckle up, because we’re diving deep into everything you need to know about this awesome card!

Now, I know what you're thinking—another credit card? But hear me out. This isn't just any credit card. The TJ Maxx Store Credit Card is specifically designed to help you save big on your favorite finds at TJ Maxx, HomeGoods, and Marshalls. And let’s be real, who doesn’t love a good deal? In this guide, we’ll break down all the perks, benefits, and even some of the potential downsides so you can decide if this card is right for you.

But before we get into the nitty-gritty, let’s talk about why TJ Maxx is such a big deal in the retail world. It’s not just another store—it’s a treasure hunt where you can score designer brands at killer prices. And with the right credit card in your pocket, those prices can get even sweeter. So, let’s dive in and see how the TJ Maxx Store Credit Card can make your shopping experience even better!

- Lucas Scott Peyton Sawyer A Love Story That Stands The Test Of Time

- High Mct Foods The Ultimate Guide To Fuel Your Body And Mind

What is the TJ Maxx Store Credit Card?

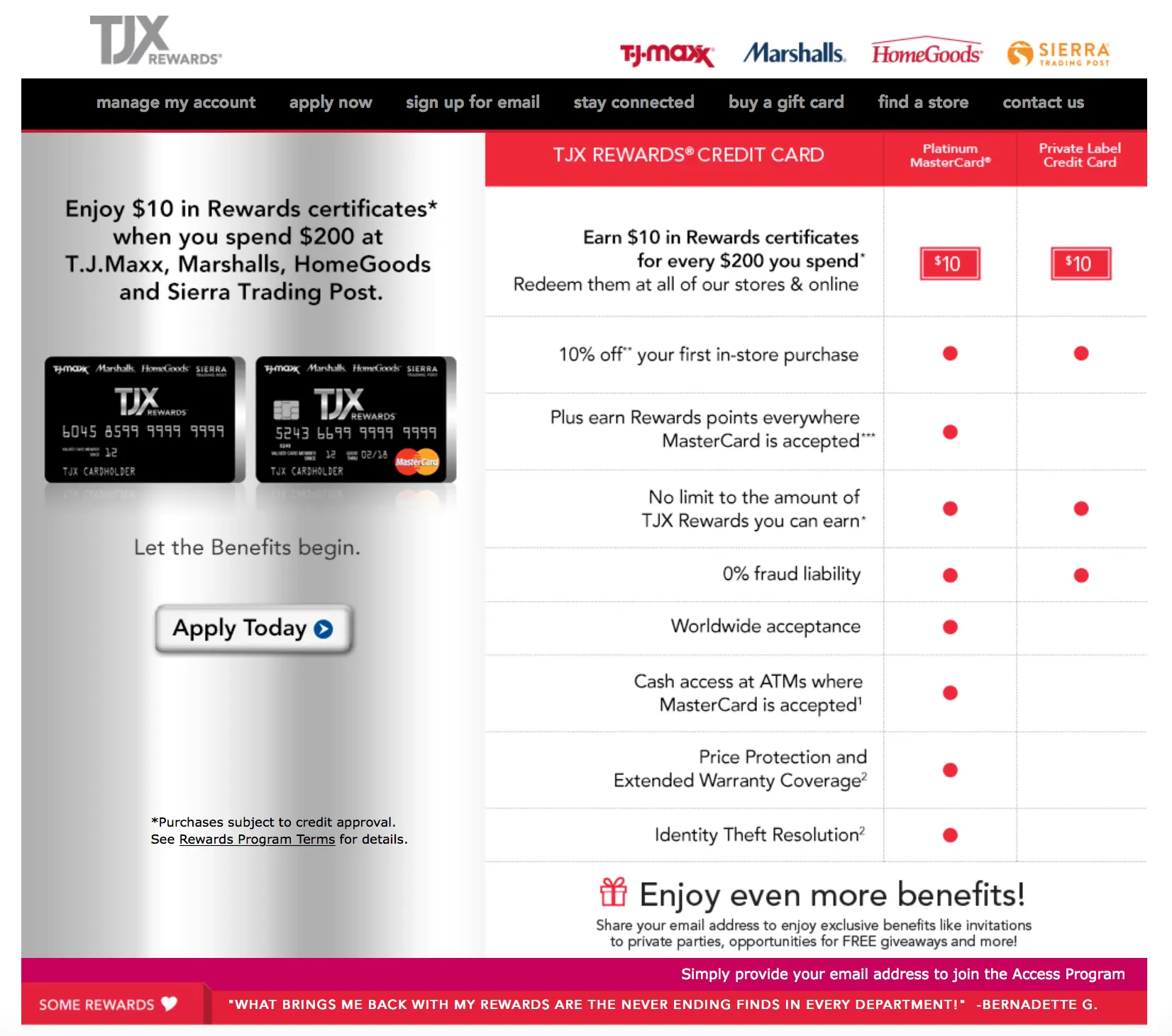

The TJ Maxx Store Credit Card is more than just a piece of plastic—it’s your ticket to exclusive discounts and rewards at your favorite TJ Maxx, HomeGoods, and Marshalls stores. Issued by Comenity Capital Bank, this card is designed to help you shop smarter and save more on your purchases. But here’s the kicker: it’s not just for TJ Maxx. You can use it across the TJX family of stores, which means even more opportunities to snag amazing deals.

One of the coolest things about the card is that it’s not just about saving money. It’s also about building credit. If you’re someone who’s looking to improve your credit score, using this card responsibly can help you do just that. Plus, it offers a range of benefits that make it a pretty attractive option for shoppers like you and me.

Benefits of the TJ Maxx Store Credit Card

Let’s face it—no one likes paying full price for anything. That’s why the benefits of the TJ Maxx Store Credit Card are worth shouting about. Here’s a quick rundown of what you can expect:

- Greta Van Fleet Band Members A Deep Dive Into Their Story And Impact

- Exploring The Best Mexican Food In Eugene Oregon

- Exclusive Discounts: Cardholders get access to special discounts that aren’t available to regular shoppers. Think of it like being part of an exclusive club.

- No Annual Fee: Yep, you read that right. This card doesn’t come with any annual fees, so you can enjoy all the perks without worrying about extra charges.

- Flexible Payment Options: Can’t pay off your balance right away? No problem. The card offers flexible payment plans to help you manage your finances.

- Easy-to-Use Online Account: Keeping track of your spending has never been easier. With the online account portal, you can view your transactions, make payments, and even set up alerts.

How Does the TJ Maxx Credit Card Work?

So, how exactly does this magic card work? It’s pretty straightforward, actually. When you sign up for the TJ Maxx Store Credit Card, you’ll get access to all the perks we talked about earlier. But here’s the thing—you need to use it responsibly. Just like any other credit card, if you don’t pay your balance on time, you could end up with some hefty interest charges.

One of the coolest features of the card is that it’s not just limited to TJ Maxx. You can use it at HomeGoods and Marshalls too, which means even more opportunities to score big on your favorite finds. Plus, the card offers a range of payment options, so you can choose what works best for your budget.

Signing Up for the Card

Getting your hands on the TJ Maxx Store Credit Card is easier than you might think. You can apply online or in-store, and the process is pretty quick. Just be sure to have some basic info handy, like your Social Security number and income details, and you’ll be good to go.

Who Should Get the TJ Maxx Store Credit Card?

Not everyone needs a store credit card, but if you’re a regular shopper at TJ Maxx, HomeGoods, or Marshalls, this card could be a game-changer for you. Here are a few reasons why you might want to consider signing up:

- You Shop Often: If you’re a frequent shopper at these stores, the discounts and rewards can really add up.

- You Want to Build Credit: Using the card responsibly can help you improve your credit score over time.

- You’re Looking for Flexible Payment Options: If you need some extra time to pay off your balance, this card offers flexible payment plans to help you out.

Is the TJ Maxx Credit Card Right for You?

Now, let’s be real—this card isn’t for everyone. While it offers some awesome benefits, there are a few things to keep in mind. For starters, if you’re not a regular shopper at TJ Maxx, HomeGoods, or Marshalls, you might not get as much value out of the card. And if you’re not great at paying off your balance on time, those interest charges can start to add up.

But if you’re someone who loves to shop and wants to save money while doing it, this card could be a great fit. Just be sure to use it responsibly and take advantage of all the perks it has to offer.

Pros and Cons

Let’s break it down even further with a quick list of pros and cons:

- Pros:

- Exclusive discounts and rewards

- No annual fee

- Flexible payment options

- Helps build credit

- Cons:

- High interest rates if you don’t pay on time

- Limited to TJX family of stores

- Not ideal for infrequent shoppers

How to Maximize Your Benefits

So, you’ve got the card—now what? Here are a few tips to help you get the most out of your TJ Maxx Store Credit Card:

- Use It Strategically: Don’t just use the card for every little purchase. Save it for big-ticket items where the discounts will really make a difference.

- Pay Off Your Balance: Try to pay off your balance in full each month to avoid those pesky interest charges.

- Take Advantage of Promotions: Keep an eye out for special promotions and discounts that are only available to cardholders.

Common Questions About the TJ Maxx Credit Card

Got questions? We’ve got answers. Here are some of the most common questions people have about the TJ Maxx Store Credit Card:

What Happens if I Miss a Payment?

If you miss a payment, you’ll likely be hit with a late fee and your interest rate could go up. That’s why it’s so important to pay your balance on time. If you think you might have trouble making a payment, reach out to customer service to see if they can work with you.

Can I Use the Card Online?

Absolutely! You can use your TJ Maxx Store Credit Card to shop online at tjmaxx.com, homegoods.com, and marshalls.com. Just be sure to log in to your account to access all the perks and discounts.

Is There a Limit on How Much I Can Spend?

Yes, there is a credit limit on the card, and it will depend on your creditworthiness. If you’re not sure what your limit is, you can check it in your online account or by calling customer service.

Final Thoughts

So, there you have it—everything you need to know about the TJ Maxx Store Credit Card. Whether you’re a seasoned shopper or just starting out, this card could be a great way to save money and build credit. But remember, with great power comes great responsibility. Use the card wisely, and you’ll be well on your way to shopping smarter and saving more.

Now, it’s your turn. Have you tried the TJ Maxx Store Credit Card? What do you think? Leave a comment below and let us know. And if you found this guide helpful, don’t forget to share it with your friends. Happy shopping, y’all!

Table of Contents

- What is the TJ Maxx Store Credit Card?

- Benefits of the TJ Maxx Store Credit Card

- How Does the TJ Maxx Credit Card Work?

- Who Should Get the TJ Maxx Store Credit Card?

- Is the TJ Maxx Credit Card Right for You?

- How to Maximize Your Benefits

- Common Questions About the TJ Maxx Credit Card

- Final Thoughts

- July 5 Birthday Personality What Defines You As A Leo Rising Star

- Doordash Advertising The Ultimate Guide To Boost Your Food Delivery Business

How to Cancel tj Maxx Credit Card SolutionBlades

Credit Card Tj Maxx

Tj Maxx Credit Card Interest Rate GESTUIK