California Department Of Tax And Fee: A Comprehensive Guide For Everyday People

So, you’ve probably heard about the California Department of Tax and Fee Administration (CDTFA), right? But do you really know what it does or how it impacts your life? Whether you’re a small business owner, a regular taxpayer, or just trying to figure out where all your money goes, understanding this department is key. The CDTFA plays a crucial role in managing taxes and fees across the state, and it’s not just about numbers—it’s about your wallet too. So, let’s break it down in a way that makes sense, even if you’re not an accountant or a tax expert.

Now, you might be wondering why this matters so much. Well, here’s the deal: the California Department of Tax and Fee is like the backbone of the state’s financial system. It collects taxes, administers fees, and ensures everything runs smoothly. But let’s be real—it’s not exactly easy to understand, especially when you’re dealing with all those forms, deadlines, and regulations. That’s why we’re here. This guide is designed to help you navigate the world of taxes and fees without losing your mind.

Before we dive in, let me tell you something important. This isn’t just about numbers and legal jargon. It’s about you—your money, your business, and your future. By the end of this article, you’ll have a clearer picture of how the CDTFA works, what it means for you, and how to stay on top of your financial game. So, grab a coffee, sit back, and let’s get into it.

- Biggie Kids The Ultimate Guide To Raising The Next Generation Of Superfans

- Moist Critical Girlfriend Break Up A Deep Dive Into Love Loss And Moving Forward

Understanding the Basics of the California Department of Tax and Fee

Alright, let’s start with the basics. The California Department of Tax and Fee Administration (CDTFA) is basically the state’s tax collector. But it’s not just about collecting taxes—it also handles things like sales tax, excise tax, use tax, and even some environmental fees. Think of it as the main hub where all your tax-related questions get answered.

What Does the CDTFA Actually Do?

Here’s the scoop: the CDTFA manages a wide range of tax and fee programs. They make sure businesses pay their fair share, enforce tax laws, and provide resources to help taxpayers understand their obligations. Some of the key areas they focus on include:

- Sales and Use Tax: This is the tax you pay when you buy stuff in California. It’s a big deal because it funds a lot of state programs.

- Excise Tax: This one’s for specific products like alcohol, tobacco, and cannabis. Yeah, even your favorite vape gets taxed here.

- Environmental Fees: From recycling to hazardous waste disposal, the CDTFA makes sure companies follow the rules and pay up.

So, whether you’re buying groceries or running a business, the CDTFA is involved in some way. And trust me, you don’t want to mess with them—they’re serious about compliance.

- Taylor Pauls Exhusband The Untold Story Behind The Spotlight

- How To Apply For Food Stamps In Hawaii A Stepbystep Guide

How the CDTFA Impacts Your Daily Life

Now, let’s talk about how this department affects you on a day-to-day basis. You might not realize it, but the CDTFA plays a huge role in shaping your financial life. Here’s how:

Taxes on Everyday Purchases

Every time you buy something in California, chances are you’re paying sales tax. The CDTFA sets the rates, collects the money, and ensures it goes to the right places. This tax helps fund schools, infrastructure, and other public services. So, while it might seem like just another expense, it actually benefits the community as a whole.

Business Taxes and Fees

If you’re a business owner, the CDTFA is your go-to resource for all things tax-related. From registering your business to filing quarterly returns, they’ve got you covered. But here’s the thing: staying compliant can be tricky. That’s why it’s important to stay informed and use the resources they provide.

Key Programs Managed by the CDTFA

Let’s take a closer look at some of the major programs run by the California Department of Tax and Fee. These programs are designed to ensure fairness, transparency, and accountability in the state’s tax system.

Sales and Use Tax Program

This program is all about collecting taxes on retail sales. It’s one of the biggest sources of revenue for California, and it affects pretty much everyone. Whether you’re buying a new phone or grabbing lunch at your favorite café, the sales tax is there. The CDTFA makes sure businesses collect the right amount and remit it to the state.

Excise Tax Program

Now, let’s talk about excise taxes. These are special taxes on specific products, like alcohol, tobacco, and cannabis. The CDTFA regulates these industries closely to ensure compliance and generate revenue. For example, if you’re a cannabis business, you’ll need to pay excise tax on every sale. It’s a complicated process, but the CDTFA provides detailed guidelines to help you navigate it.

Environmental Fee Program

California is all about sustainability, and the CDTFA plays a big role in that. They manage fees related to recycling, waste disposal, and environmental protection. This helps fund programs that keep the state clean and green. So, the next time you recycle your soda can, remember that the CDTFA is behind it.

How to Stay Compliant with the CDTFA

Staying compliant with the California Department of Tax and Fee might sound intimidating, but it’s totally doable. Here are some tips to help you stay on the right side of the law:

Register Your Business Properly

If you’re a business owner, the first step is to register with the CDTFA. This ensures you’re authorized to collect and remit taxes. You’ll need to provide some basic info, like your business name and address. Once you’re registered, you’ll get access to all the resources you need to stay compliant.

File Your Taxes on Time

Deadlines are a big deal when it comes to taxes. Missing a filing deadline can lead to penalties and interest charges, so it’s important to stay on top of things. The CDTFA provides online tools to make the process easier, so take advantage of them. Plus, filing early can help you avoid last-minute stress.

Keep Accurate Records

Record-keeping is key to staying compliant. Make sure you keep detailed records of all your transactions, including receipts, invoices, and tax payments. This will come in handy if you ever need to audit or dispute a tax issue. The CDTFA even offers guidance on how to maintain proper records.

Common Misconceptions About the CDTFA

There are a lot of myths floating around about the California Department of Tax and Fee. Let’s clear up some of the confusion:

Myth #1: The CDTFA Only Cares About Big Businesses

Wrong! The CDTFA works with businesses of all sizes, from tiny startups to huge corporations. They provide resources and support to help everyone comply with tax laws. So, don’t think you’re off the hook just because you’re a small business owner.

Myth #2: You Can Avoid Paying Taxes

Sorry, folks, but this one’s a no-go. Trying to evade taxes is not only illegal but also a really bad idea. The CDTFA has systems in place to catch non-compliance, and the consequences can be severe. It’s always better to pay your fair share and avoid trouble.

Resources and Tools Provided by the CDTFA

The CDTFA offers a ton of resources to help taxpayers and businesses stay informed. Here are a few you should check out:

Online Services

The CDTFA website is packed with useful tools, like online registration, tax filing, and payment options. You can even access your account information and track your tax history. It’s a one-stop shop for all your tax needs.

Guidance and Publications

Need more info? The CDTFA publishes guides, FAQs, and newsletters to keep you up to date on the latest tax laws and regulations. They also offer webinars and workshops to help you learn more about specific topics.

How the CDTFA Supports Economic Growth

Believe it or not, the CDTFA plays a big role in promoting economic growth in California. By collecting taxes and fees fairly, they help fund programs that benefit everyone. Here’s how:

Funding Public Services

Taxes collected by the CDTFA go toward things like education, healthcare, and infrastructure. These services are essential for a thriving economy. Without them, businesses wouldn’t have the resources they need to succeed.

Encouraging Compliance

When everyone pays their fair share, it creates a level playing field for businesses. This encourages competition and innovation, which are key drivers of economic growth. The CDTFA works hard to ensure compliance, which benefits everyone in the long run.

Challenges Faced by the CDTFA

Of course, the California Department of Tax and Fee isn’t without its challenges. Here are a few issues they’re currently dealing with:

Changing Tax Laws

Tax laws are constantly evolving, and the CDTFA has to keep up. This means updating systems, training staff, and educating taxpayers on the latest changes. It’s a lot of work, but they’re committed to staying ahead of the curve.

Combatting Tax Fraud

Tax fraud is a big problem, and the CDTFA is working hard to combat it. They use advanced technology and data analytics to detect and prevent fraud. It’s an ongoing battle, but they’re making progress.

Conclusion: Why You Should Care About the CDTFA

So, there you have it—a comprehensive guide to the California Department of Tax and Fee. Whether you’re a taxpayer or a business owner, understanding this department is crucial. It affects everything from your daily purchases to your long-term financial goals.

Here’s what you should take away from this article:

- The CDTFA manages a wide range of tax and fee programs that impact your life.

- Staying compliant is important, but it’s totally doable with the right resources.

- The CDTFA plays a key role in promoting economic growth and supporting public services.

Now, here’s the call to action: if you’ve found this article helpful, share it with your friends and family. The more people understand the CDTFA, the better off we all are. And if you have any questions or comments, feel free to leave them below. Let’s keep the conversation going!

Oh, and one last thing—don’t forget to check out the CDTFA website for more info. They’ve got tons of resources to help you stay informed and compliant. So, go ahead and take control of your tax game. You’ve got this!

Table of Contents

- Understanding the Basics of the California Department of Tax and Fee

- How the CDTFA Impacts Your Daily Life

- Key Programs Managed by the CDTFA

- How to Stay Compliant with the CDTFA

- Common Misconceptions About the CDTFA

- Resources and Tools Provided by the CDTFA

- How the CDTFA Supports Economic Growth

- Challenges Faced by the CDTFA

- Conclusion: Why You Should Care About the CDTFA

- Marc Anthony Tour 2024 Setlist Your Ultimate Guide To The King Of Salsas Biggest Hits

- Venezuelan Popular Food A Flavorful Journey Through Venezuelas Culinary Delights

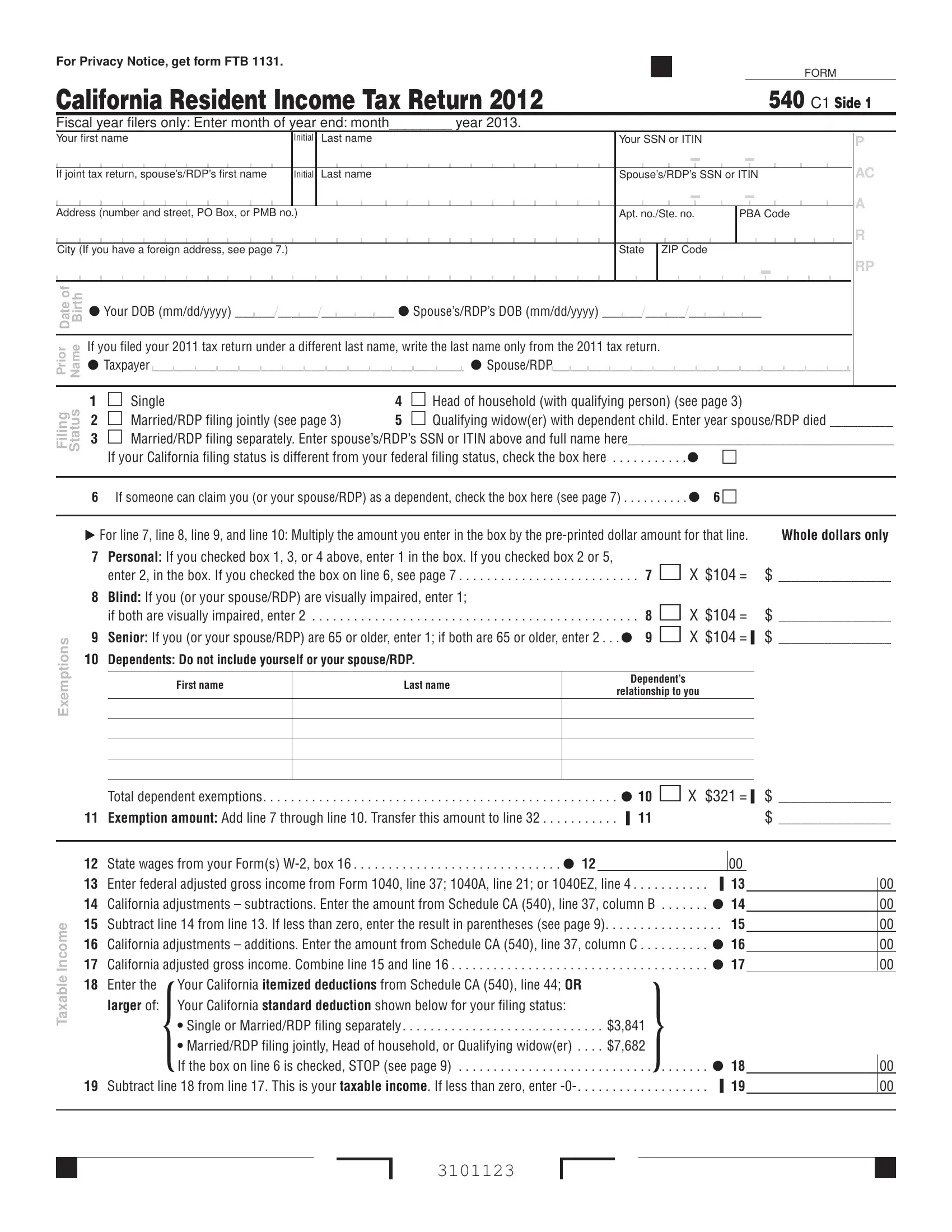

Form 540 Es California

What Are the California Department of Tax and Fee Administration and

HdL Companies Issue Update March 2021